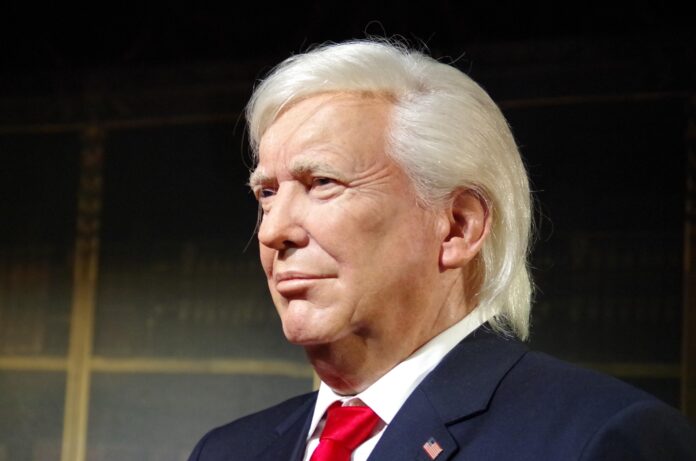

Social security is one of the vital sources of financial support for millions of Americans that rely upon the program to sustain themselves in their retirement years, or if disabled. Since the return of the Donald Trump to the presidency camp, there have been lots of actions, and attempts to alter the social security system. In this particular blog post we are to discuss amendments to the Social Security system that was made by Trump and their effects on the beneficiaries and the general future of Social Security program.

The Trump Administration’s Approach to Social Security

President Trump and other critics have time and again called for the need to cut down on costs and abundant waste in government’s expenditure. His government under the Department of Government Efficiency (DOGE) that is led by Elon Musk has tried to cut costs and efficiency. Although Trump promised several times not to reduce Social Security check, the measures taken so far have posed both, hope and fear among the recipients and scholars.

A Focus on Efficiency and Accountability

Thus, the attitude of Trump’s administration toward Social Security reflects the strategy of improving and rationalizing the procedures of governmental programs. This is due to the realization that optimizing resources and cutting down on costs can be achieved without really affecting the quality of service that is offered to the target groups. The so called The genuine victory has five strategic goals and the tasks of the administration include achieving specific objectives to minimize the administrative expenses reaching the zero level of fraud.

The Role of DOGE

Through Elon Musk’s Department of Government Efficiency (DOGE), there is a clear outline of issues within the Social Security Administration (SSA). Musk has professional experience in innovation and management, striving to use his ideas which he has applied in private enterprises in the performance of federal programs. This strategy was applauded by some scholars while other scholars opined that this strategy may overstate the problem of facing Social Security and may be detrimental to beneficiaries in the process.

Key Changes to Social Security Under Trump

1. Elimination of Paper Checks

The changes involve subjects such as the ‘no more paper checks’ for Social Security benefits. The last date that federal government will be making payment for the Social Security through check is September 30, 2025. This websiter is a strategic step towards cutting down on fraud cases and increase in efficiency. Recipients of the paper checks will have to switch to direct payment or other electronic means of payment. While this change is expected to help save the government lots of dollars spent on check fraud and also help cut the costs of check printing, it has probably proved to pose somes challenges to the senior citizens especially those who lack experience in electronic money.

The Transition to Electronic Payments

Digital payments is a new experience for most of the beneficiaries when it comes to the disposal of their payments. Over the years the paper checks have been considered the best way of delivering this cash especially to the Social Security recipients. That means that with regard to the use of electronic payments, beneficiaries must change their ways and as such. This is especially so given the fact that many of the elderly might be uncomfortable undertaking online transactions such as banking or conducting other business online.

Real-Life Impact

Mary Johnson, assuming a retiree at 72 years of age from Ohio, depends on Social Security money to survive, basics. She further suggests: “The notion of adopting electronic based payments is somehow challenging.” Almost every applicant for the job mentioned some concern, from ‘I’m not very computer literate to me, and this means that I will likely make many errors. Mary’s worries show all the difficulties that millions of elderly people have to deal with during their adaptation to the new policy.

Expert Insights

As you will see below there are various views, opinions or prognosis about this change among the professionals. Others posit that the proponents believe that the outcomes that include reduction of fraud and enhancement of efficiency offset the difficulties. Dr. Jane Smith, a social policy expert in a leading think tank said it wisely to initiate the process of replacement of paper checks to curb fraud cases and enhance efficiency. However, there is also a human aspect which a humankind must consider not to be harmed too much by the changes.

2. Reinstating the 100% Overpayment Recovery Rate

And in 2024, overpayment recovery rate slashed from the previous 100% of the monthly check to 10% of the monthly check by the Biden administration. The current Trump administration has come up with this new policy that has done away with this policy by recovery of 100% for any overpayment made on or after March 27, 2025. Fortunately, the guide states that in cases where the SSA overpays a beneficiary, it can deduct the amount owed from the subsequent month’s payment until the overpayment is met. Although it will reduce the federal government’s spending by $7 billion in the coming decade, some beneficiaries may face difficulties in repaying the accumulated large overpayments.

The Impact on Beneficiaries

It implies that the all the overpayments will be fully recovered from the respective beneficiaries. It is not difficult to imagine how it feels to be among the recipients who receive overpayments, then have the possibility of losing the entire amount one is entitled to one’s monthly benefit. A lot of the beneficiaries depend on the check they receive from social security for their basic needs and therefore losing it means they will be financially unstable.

Real-Life Impact

An overpayment of $5,000 to a 65-year disabled veteran, John Davis was an instance of an administrative mistake. To substantiate the importance of its help, Jason tells the following story: “I was barely able to support myself already.” This statement contributes to the narrative since it shows that the speaker was frightened by the decision to deduct the overpayment by withholding the whole check. It is in this instance that he says, “I shall not know how I am going to pay my bills.” This paper presents the case of JOHN about the possibility of the beneficiaries to face a range of financial difficulties as a result of the above policy.

Expert Insights

It is also noteworthy that such optimism will likely bring about discontent concerning revenue recovery among all the beneficiaries. “While valuable in eliminating fraud and overpayments the strategy looks at the other end of the spectrum and ask how to ensure that beneficiaries do not suffer extreme financial difficulties at the same time comments Dr. John Brown a social policy analyst. But there should be a more specific distinction that assigns a peculiar status to the individual.

3. Enhanced Identity Verification

Starting April 14, 2025, claimants will not be allowed to apply for Social Security benefits or give details about direct depositing through telephone calls. They cannot use the online SSA 1000A notice to confirm their identity; they have to use their name or login into the “My Social Security” account or go to an SSA field office. This will help to minimize fraud but create challenges for person who lacks computer and internet knowledge as well as people with limited computer and internet access.

The Shift to Digital Verification

The last change is the shift to digital verification which would also transform the way beneficiaries will engage with the SSA. Although the intention here is to tighten the security and minimize fraud, it closes shops for beneficiaries to embrace new technology and ways of doing things. This is rather an issue for many Americans in the older generation.

Real-Life Impact

Sara Thompson is a 70 years old widow who has been using telephone support from the SSA for many years. “To be honest, I do not feel quite at ease about computers,” she stated. As for the concept of having to enter an online account to verify oneself, it can surely be called rather unnerving. My fear is that I am going to make a mistake when doing it and as they result lose all the gains I have made.

Expert Insights

There is one voice in the global opinion that claimed that increasing ways to identify a customer is equally important to minimize fraud incidents but they should not be restrictive toward certain categories of people. ”This comes as a way of noting that we have to have measures in place for assisting computation challenged beneficiary to be vertically validated,” noted Dr. Jane Smith.

4. Office Closures and Lease Terminations

The Trump administration acting through DOGE has tried to terminate several social security office leases. Although there are no mentions of permanent shutdown that resulted in the future local offices of the company, it is stated that some offices may be closed temporarily, due to bad weather, for instance or due to problems with the building. The SSA has stated there will be no complete offices shut down, however, the cut on the latter denotes concerns on the ways the less offices will impact the possibilities of beneficiaries accessing their services.

The Impact on Accessibility

The shut down of Social Security offices have also posed a concern on the dependency of beneficiaries on the offices. The SSA uses the term ‘no forced closures of offices ‘making it difficult to tell if people will be unable to access face to face help due to fewer offices because of the reduction in office leases. This is quite concerning especially to those beneficiaries who would need physical help at the local offices to address some of their problems or those who have no means of transacting to the offices.

Real-Life Impact

Tom Martinez is a sixty-eight-year old man, who currently resides in a rather remote area; there are no possibilities to use public transport. He: The nearest Social Security, he says, is over 50 miles away. There are still different possibilities for their office, as one of them is to close it, and I have no idea how I would get the assistance I require. This leaves me to have no choice but to go through all the rigours of traveling all the way to seek an answer or help. Tom’s experience demonstrates the possible difficulties experienced by the beneficiaries in the event of closures of offices.

Expert Insights

According to the fact that such services should remain accessible to the beneficiaries, they should be preserved by experts. ”Meaning, though administrative costs have to be cut down, beneficiaries should be able to get assistance as they deserve,” remarks Dr. John Brown. “This could include increasing online services or increasing the number of mobile units that offer help to the beneficiaries in rural or remote areas of the country.”

5. Transparency Initiatives

Currently, the SSA has embarked on measures to increase its accountability through the following measures. These include coming up with weekly operational reports and putting more information regarding availability of its services on YouTube for the public. These are to enhance the communication with the customers and to explain more to the beneficiaries about the functioning of the SSA.

The Benefits of Transparency

It will be seen that by providing different forms of transparency, a number of advantages can flow to the beneficiaries as well as the SSA. Offering relevant information concerning operation and wait time is likely to increase the level of communication between the SSA and the beneficiaries, thereby enhancing their rapport. This can be on an indirect way in contributing to the overall enhancement of the HIV and AIDS situation as it has positive effects on the involved parties.

Real-Life Impact

For a beneficiary such as Mary Johnson transparency measures can come as a welcome addition. The third reported concern was the time taken to process the benefits: “That is why I always worry how long it will take to get the benefits answered,” she said. Abiding knowledge regarding the long waits that are likely to be encountered and the way the SSA administration works are good for me since it eases my worries.

Expert Insights

Unfortunately, experts have opined that the following pronouncements of the SSA are correct The SSA has acknowledged this stance by moving in the direction of transparency. According to Dr. Jane Smith, more information on operations and the amount of time clients will need to wait for services delivery a way of enhancing client relations among the beneficiaries. Such is aimed at ensuring that different parties get better results at the end of the process.”

The Future of Social Security Under Trump

The Promise of Tax Elimination

Indeed, during his campaign to the presidency, Trump pledged not to tax Social Security benefits. Although it would help millions of retired citizens to have more money they need to spend, at the same time, it will worsen the Social Security trust fund problem. Reduction in taxation of benefits may entail a loss of $ 1.5 trillion in revenues under the next decade and the trust fund may run dry two years before the estimates indicate.

The Financial Implications

It is self-explanatory that utilization of no taxes on Social Security benefits point towards considerably influential finance. The short-term implication would be a healthier future for the beneficiaries from the increased amount of money they shall from now receive monthly but the future of the program is bleak. The current Social Security trust fund is also threatened by funding problems and thereby eradicating taxes on benefits will worsen this progression.

Real-Life Impact

That is why some people look forward to the elimination of taxes while others fear this moment with the example such an attitude given by a retiree like John Davis. If more money could be placed in her check month after month, that would be ideal according to him. I also enjoy the programs but I have some concerns about the sustainability of such a program in the future. “If we knock out taxes on the benefits, I do not know how the programme will be financed.”

Expert Insights

Nevertheless, students and educators have differing opinions as to the effects of the elimination of taxes on social security benefits. Critics have the idea that the adjustment will cut expenditure and offer vital financial help a pensioner, while the opponents raise concern over the prospects of the program. Dr John Brown, a manager says, “Removing taxes on the benefits would be of quick benefit to the beneficiaries, but it will be disadvantageous to the program”. “It is very dangerous to make such a move because we need to think twice about its consequences in the future.”

The Role of DOGE

Subpoenas offered by Elon Musk’s DOGE have been the pioneers in identifying wasted fiscal spending and ineffective programs in the federal government, specifically Social Security. There are still questions on how the changes will likely affect the organisations’ beneficiaries in spite of the drive for administrative efficiency. Musk has said that a large part of the money collecting in the entitlement programs, including Social Security, is fraudulent, and has predicted he will eliminate $2 trillion in federal expenditure. This would be a difficult feat to accomplish if one were to avoid reductions in benefits altogether.

The Potential for Innovation

This newly adopted policy in DOGE does not come empty handed as its creativity has the capacity to offer key changes to Social Security policy. He is a visionary technocrat with immense knowledge in efficient operations of organizations, and hence, his appointment to head the SSA has the potential of turning around the organization for the better. However, according to the authors of the research, there are certain risks an organization faces when implementing these changes and such changes should be done with a lot of careful consciousness.

Real-Life Impact

For any beneficiary such as Sara Thompson, the engagement of DOGE has been inspiring and worrying at the same time. she expressed her optimistic words to make multi-billion dollar for the system and to minimize the impacts of fraud. However, I doubt that it will be beneficial for them as consumers to get together and change what could be detrimental to its beneficiaries.

Expert Insights

Particularly, there is a consensus among the experts which states that, while innovation is apparently crucial, its implementation cannot ignore the protection of beneficiaries. According to the verbal interview held with Dr. Jane Smith, DOGE has the potential to improve the SSA in numerous ways however, we must prevent negative impacts on beneficiaries. “The results of this study suggest that any change implemented should undergo critical analysis in order to have positive effects on the stakeholders.”

Conclusion

Making changes to the Social Security program is one of the main focal points of the administration, which seeks to cut on the costs of the program in order to come up with long-term solutions to conditions in the program. Some of the proposed measures, like the exclusion of paper checks and an increased level of identification, can lead to the decrease of frauds and the improvement of work; however, they represent the problems for beneficiary. Containing the rate of ‘Overpayments’ recovery at 100 percent and the possible shut down of the Social Security offices make it a major worry in as far as the financial security of the beneficiaries is concerned and their accessibility to the services as well.

Based on these changes being implemented by the administration, efforts should be made to determine the effects on the beneficiaries and guarantee that vulnerable beneficiaries are not neglected. Transparency initiatives and the potential involvement of DOGE offer opportunities for innovation

FAQs on Trump Social Security Policy

1. What innovations of the new president affect the Social Security program?

The following are features that have been introduced under the Trump administration with regards to Social Security: prohibition on the use of checks by September 30, 2025, the recovery rate of 100% on all overpayments is back, a stricter identity verification will commence from April 14, 2025, the possible closure of offices and more visibility.

2. How will the scrap of paper checks impact those that are expected to benefit from it?

Recipients will have to switch to direct check or any other digital means of receiving money. This change addresses the issue of fraud and also increases efficiency, but at the same time, may cause certain difficulties to people not using electronic banking services.

3. What this means is that the current recovery rate for overpayment is one hundred percent?

Specifically, the increase of the 100% overpayment recovery rate means that the SSA can deduct the total amount of the monthly benefit to recover the overpayment. This would mean that beneficiaries tender through undue large overpayments and thus, it make feel financial stress when repaying the amount.

4. For what reasons is ID verification is being taken through to the next level?

Improved LLIS seeks to minimise fraud by forcing the beneficiaries to use ‘My Social Security’ online account or physically present themselves at the SSA offices for confirmation of their identity. This may be forcing for the people who are a bit reluctant when it comes to using the latest technologies.

5. This includes the following: * Which transparency initiatives are being introduced?

Down to the present, the SSA continues producing weekly operation reports, which are posted on their YouTube channel, and providing additional information regarding wait time and operation to the public to address customer satisfaction.